Enron, once a respected energy company, collapsed in 2001 due to financial fraud and deceptive accounting practices. The scandal led to bankruptcy, job losses for employees, and financial losses for investors. Top executives faced legal repercussions, and the incident prompted regulatory reforms like the Sarbanes-Oxley Act in 2002.

Table of Contents

Founding of Enron and its rise

Founded in 1985 by Kenneth Lay through the merger of Houston Natural Gas Corporation and InterNorth, Inc., Enron initially focused on natural gas transmission. Deregulation laws in the early 1990s prompted a shift, led by Jeffrey Skilling, who transformed Enron into an energy derivative contracts trader. Serving as an intermediary between gas producers and customers, Enron, under Skilling’s leadership, dominated the natural-gas contracts market, yielding substantial profits.

Skilling’s influence fostered an aggressive trading culture, attracting top talent and intensifying competition within the company. Andrew Fastow, recruited by Skilling, became Enron’s CFO, managing complex financing instruments. Amid the 1990s bull market, Enron’s rapid growth expanded its trading ventures to diverse commodities, from electricity to weather derivatives. The company’s online trading platform, Enron Online, thrived during the dot-com boom, handling daily transactions worth approximately $2.5 billion by 2001. Enron also invested in a broadband network for high-speed trading. However, these ambitious pursuits ultimately set the stage for Enron’s dramatic downfall in the early 2000s.

Downfall and bankruptcy

Enron’s downfall was marked by the culmination of deceptive financial practices as the company faced heightened competition in the energy-trading sector, leading to a rapid decline in profits. Faced with shareholder pressure, Enron executives resorted to dubious accounting methods, including the use of “mark-to-market accounting,” which allowed them to portray unrealized future gains as current income. This tactic created a facade of robust profits, concealing the company’s actual financial troubles.

To further mask its deteriorating financial health, Enron engaged in the strategic transfer of troubled operations to special purpose entities (SPEs), essentially limited partnerships with external parties. However, Enron’s misuse of SPEs went beyond industry norms, as these entities became dumping grounds for troubled assets. By keeping these assets off Enron’s books, the company downplayed the severity of its losses. Notably, some of these SPEs were under the control of Enron’s own executive, Andrew Fastow.

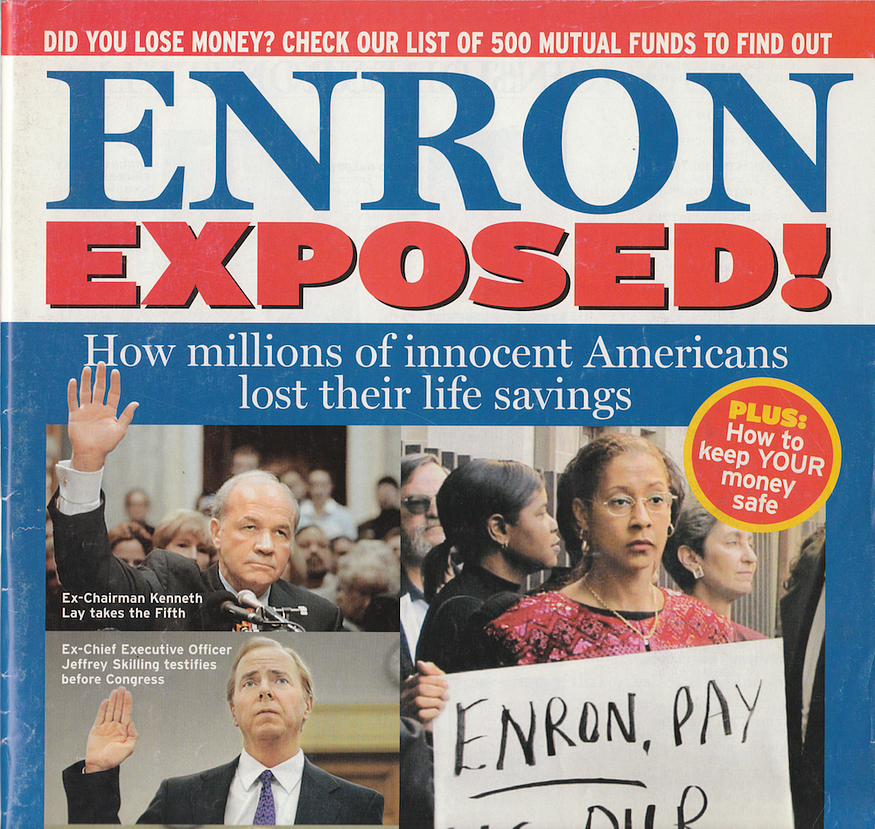

In 2001, Enron’s leadership underwent a significant change when Jeff Skilling took over as CEO. However, Skilling’s abrupt resignation in August prompted Kenneth Lay to reassume the role. Around the same time, an anonymous memo from Enron vice president Sherron Watkins raised concerns about Fastow’s partnerships, warning of potential accounting scandals.

The gravity of the situation came to light in mid-2001 when analysts scrutinized Enron’s financial statements. In October, the company shocked investors by announcing a $638 million loss for the third quarter and a $1.2 billion reduction in shareholder equity, partly attributable to Fastow’s partnerships. The Securities and Exchange Commission (SEC) initiated an investigation into transactions between Enron and Fastow’s SPEs. Concurrently, officials at Enron’s auditor, Arthur Andersen, were implicated in document shredding related to Enron audits.

The unraveling of Enron’s financial misdeeds triggered a swift decline. Fastow was fired, and the company’s stock price plummeted from $90 per share in mid-2000 to under $12 by November 2001. Despite an attempted acquisition by Dynegy, the deal fell through, causing Enron’s stock to crash below $1 per share. On December 2, 2001, Enron filed for Chapter 11 bankruptcy protection, marking one of the most notorious corporate collapses in history.

People who play the cards

Ken Lay, Enron’s CEO, hid massive debt through off-balance sheet entities. Politically connected, he faced 11 charges and was convicted of conspiracy, fraud, and false statements in the Enron scandal.

Jeffrey K. Skilling: The Stock Seller COO: Skilling, Enron’s COO, sold stock before the scandal, denied fraud knowledge, and was convicted on fraud, insider trading, and securities fraud charges.

Andrew S. Fastow: Finance Chief Turned Fraudster: Enron’s CFO, Fastow, orchestrated off-the-books partnerships to hide losses, pleaded guilty, and now faces prison while cooperating with prosecutors.

Ben F. Glisan Jr.: Inner Circle to Jail Cell Treasurer, Enron’s treasurer, Glisan, engaged in fraud schemes, pleaded guilty, served time, and testified against others involved in fraudulent activities.

Mark E. Koenig: Conference Call Debacle Director, Koenig, Enron’s director of investor relations, pleaded guilty to securities fraud, cooperated with prosecutors, and awaits sentencing for his role in misleading investors.

Lou Lung Pai: Stock Seller with a Taste for Glitter, Enron executive Pai, known for lavish spending, sold stock, faced lawsuits, and, though not charged, remains on the defense’s potential witness list.

Kenneth D. Rice: Broadband Unit CEO Turned Fraudster, Enron executive Rice, charged with fraud, sold stock at inflated prices, pleaded guilty, and awaits sentencing while cooperating with prosecutors.

Greg Whalley: President Fostering Fun on the Trading Floor, Enron’s former president Whalley, known for fun on the trading floor, cooperated with investigators post-Enron, faced lawsuits, and found a role in a hedge fund.

Nancy Temple: Andersen Lawyer and Troubling Memos, Andersen lawyer Temple advised on document destruction, faced charges, and continues practicing law while dealing with Enron-related legal issues.

Rebecca Mark: Global Ambassador Off the Fast Track, Enron’s international business executive Mark faced criticism for bad deals, settled with shareholders, and may be a witness in the Lay and Skilling trial.

Whistleblowers

Sherron S. Watkins: The Whistle-Blower from the Neighborhood Watkins, the Enron vice president turned whistleblower, wrote a letter exposing accounting practices, continues advocating for corporate ethics, and is a potential witness in the trial.

Vincent J. Kaminski, the unsung hero at Enron, foresaw the unethical off-the-books dealings that led to the company’s downfall. Despite internal battles and warnings, Kaminski’s loyalty to truth prevailed. Now at Citigroup, he teaches, writes, and remains a respected figure in energy risk management.