Table of Contents

Indian markets increased by 20% in 2023, marking the record ninth year of growth.

With 20% gains at year’s end, the Nifty 50 enjoyed its ninth year of positive returns since 2015. Accordingly, 2023 ranks as the index’s fourth-best year over the previous ten years. Preponderance Of Nifty 50 Gains By 2023 The only Nifty 50 company to double its value in 2023 was Tata Motors Ltd., which made headlines on the last trading day of the year. NTPC Ltd., Larsen & Toubro Ltd., Bajaj Auto Ltd., and Coal India Ltd. were among the other notable victors.

A surge in electricity demand propelled the PSU sector, which included NTPC and Coal India, to their best calendar-year results. 48 of the Nifty 50 stocks had a good year-end performance. On the other hand, Adani Enterprises Ltd. and UPL Ltd. ended the year with respective losses of 26% and 18%. The chemical industry had a difficult year due to de-stocking and excessive dumping from China.

Top Nifty 50 Gainers and Laggards

| Stock | Year Change(%) | Stock | Year Change |

|---|---|---|---|

| Tata motors | 103% | UPL Ltd. | -18% |

| NTPC | 87% | Adani Enterprises | -26% |

| Bajaj Auto | 86% | ||

| Larsen & Toubro | 68% | ||

| Coal India | 67% |

Strong Momentum Is Seen in Broader Markets

In 2023, the larger markets became the main motivators. 2023 saw the biggest-ever increases for the Midcap 100 and Smallcap 100 indices, which had risen for 25 and 14 sessions in a straight, respectively.

REC Ltd. and Power Finance Corp., which increased by 3.5 and 3.4 times, respectively, were the main drivers of the Midcap 100 index’s 46% gain. Mazagon Dock Shipbuilders Ltd.’s share price nearly tripled as a result of the drive for domestic defense manufacturing. Ninety-three equities in the Midcap 100 pack had favorable results. The leading laggards, Aditya Birla Fashion and Retail Ltd., ACC Ltd., and Page Industries Ltd., had decreases of 22.5%, 10%, and 5%, respectively.

Top Gainers And Laggards in 2023

| Stock | Year Change(times) | Stock | Year Change(times) |

|---|---|---|---|

| REC | 3.5x | Aditya Birla Fashion and Retail | -23% |

| Power Finance Corporation | 3.4x | ACC | -10% |

| Indian Railway Finance Corporation | 3.0x | Page Industries | -10% |

| Mazagon Dock Shipbuilders | 2.9x | Crompton Greaves Consumer Electricals | -8% |

| Rail Vikas Nigam | 2.6x | Gujarat Gas | -5% |

In 2023, the Smallcap 100 saw a 55% increase. With gains multiplied fourfold, BSE Ltd. stood out as the best performance among the group. Suzlon Energy Ltd. increased by 3.6 times, benefiting from the trend toward renewable energy.

Easy Trip Planners Ltd. and Campus Activewear Ltd. encountered difficulties. Easy Trip Planners’ IPO was over 159 times subscribed, yet the company’s shares saw a 25% decline by year’s end.

Top Gainers And Laggards Of 2023

| Stock | Change(in times) | Stock | Change(in %) |

|---|---|---|---|

| BSE | 4.0x | Campus Activewear | 32% |

| Suzlon Energy | 3.6x | Easy Trip | 25% |

| Apar Industries | 3.3x | Aavas Financiers | 18% |

| Zensar Technologies | 2.9x | Shree Renuka | 17% |

| Nlc India | 2.9x | City Unicorn | 16% |

Banks behind Nifty Realty, the sector’s top performer

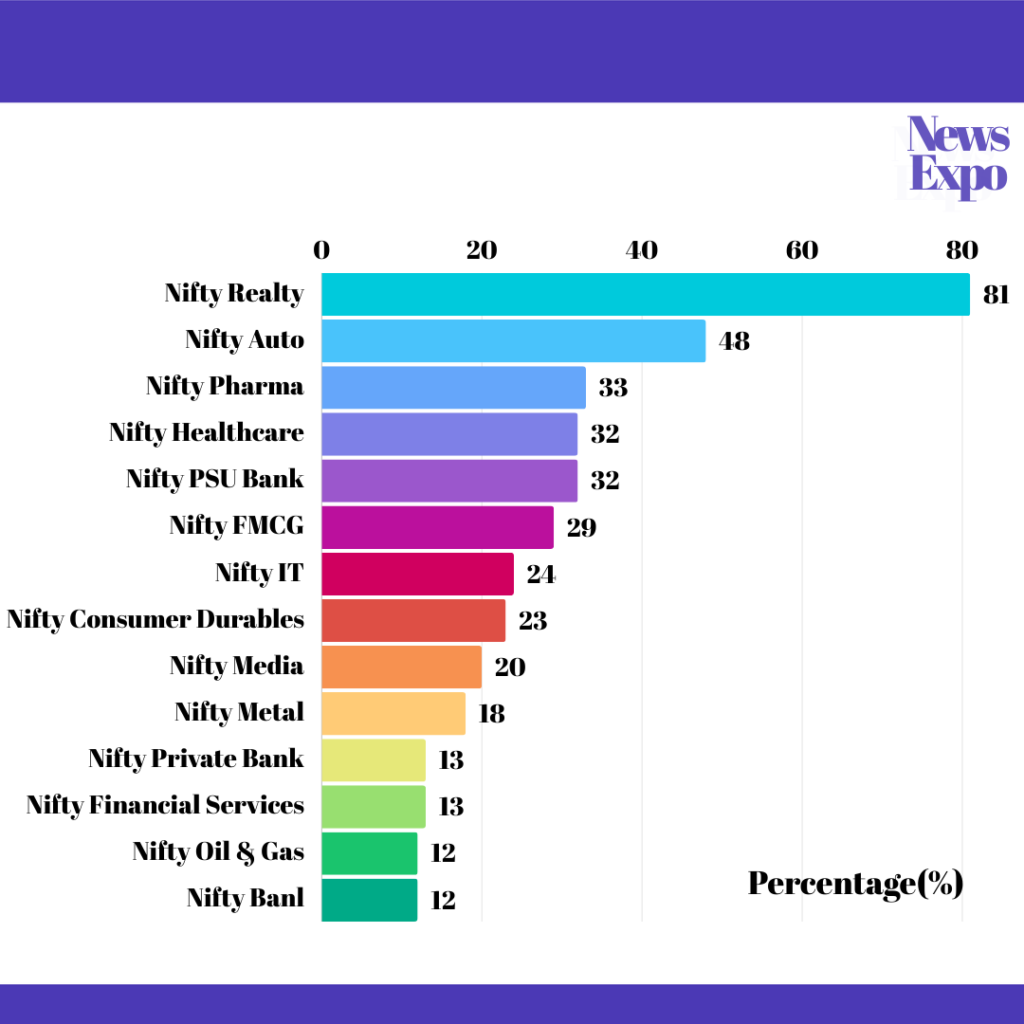

Brigade Enterprises Ltd., DLF Ltd., and Prestige Estates Projects Ltd. propelled Nifty Realty to the top of the sector with an 81% increase. Nifty Pharma and Nifty Auto both did well, expanding by 32% and more than 47%, respectively. This year’s favorable regulatory reforms, stable demand, and a decline in commodity costs all helped the auto industry. Nonetheless, more moderate increases of 11%, 12%, and 12%, respectively, were recorded by sectors such as Nifty Bank, Nifty Oil and Gas, and Nifty Financial Services. Among the underachievers in these areas were SBI Cards and Payment Services Ltd., Adani Total Gas Ltd., Gujarat Gas Ltd., Kotak Mahindra Bank Ltd., and Bandhan Bank Ltd.

Sectoral Performance In 2023